Payment initiation service

Lower e-shop transaction costs

This instant account-to-account payment initiation service allows your e-commerce business to reduce transaction costs on payment processing.

Using the Payment Initiation Service (PIS) lets you accept payments at a lower cost than for cards, invoices, bank links or alternative payment methods.

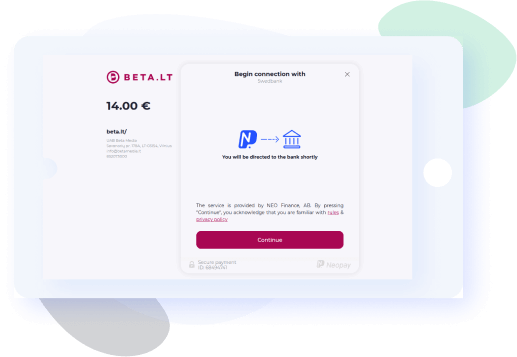

Convenient online buyer journey

The convenient and simplified customer journey enables customers to pick their bank to initiate a payment order.

More features. More benefits.

Activate a full range of instant payment solutions with PIS

Simplify your payment process with Neopay by automating:

- Refunds

- Recurring payments

Reach out to a more diverse set of customers with alternative payment methods:

- Active payment links

- QR code solutions

Set your own rules for exactly who can make payments with Neopay and how.

Customize widget design

Adapt payment widget to your own customized design to maximise conversions.

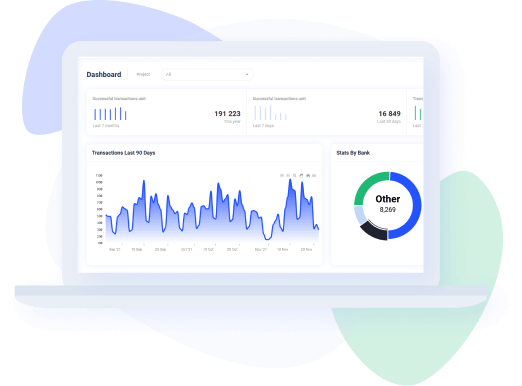

Track statistics easily

Track your transactions statistics and manage settings in your personal Neopay dashboard.

How does it work?

1

integration

15

European countries

200+

financial institutions

The Payment Initiation Service (PIS) is a payment method based on an open banking system.

Neopay’s payment initiation service (PIS) enables e-commerce merchants to accept payments directly from banks (account-to-account), taking full advantage of open banking APIs.

The service works through APIs with banks and other financial institutions as required by the Second Payment Services Directive (PSD2) and as licenced and regulated by the central bank.

PIS stands for secure, safe and smooth API connections with payers’ bank accounts all over the Europe.

Neopay also supports secure instant payments.